An Unbiased View of Home Equity Loan copyright

Table of ContentsHome Equity Loan copyright for BeginnersWhat Does Home Equity Loan copyright Do?Home Equity Loan copyright Fundamentals ExplainedThe smart Trick of Home Equity Loan copyright That Nobody is Talking AboutEverything about Home Equity Loan copyright

Given that all the cash is supplied ahead of time, it is often made use of to spend for huge jobs like home remodellings. Home equity is the part of your home that you own outright, and constructs as you make home loan repayments gradually. You can determine roughly just how much home equity you have by subtracting exactly how much you owe on your home loan from your home's value.ProsCons The predictability of a home equity finance's repayments can make budgeting simpler. Home equity lending closing costs are commonly more budget-friendly than what you would certainly pay with a cash-out refinance.

Determine how much cash you can obtain The simplest method to find out just how much cash you could receive with a home equity funding is to utilize an on-line home equity car loan calculator. If you wish to do the mathematics by hand, just multiply your home's value by 85% (0.85 ), after that subtract what you have delegated pay on your present home loan.

3. Contrast multiple lending institutions Connect to three to five loan providers and see what kind of home equity funding terms they might agree to supply you. You can get in touch with banks, credit score unions, and online loan providers to obtain quotes to contrast and locate your finest offer. Make sure you look at quotes for rates of interest, lending terms and month-to-month repayments, costs and fees, and other information to see to it you select the most effective offer for you.

The Definitive Guide for Home Equity Loan copyright

Eventually, you should investigate loan providers and contrast shop to obtain the finest deal on a home equity car loan. If you're not certain where to start, inspect out our listing of the ideal home equity lending institutions in the table listed below.

Putting your house on the line for nonessentials especially ones that will not pay for themselves doesn't normally make good financial sense. Comparable to a home equity car loan, a HELOC is a bank loan that enables you to transform some of your home equity into cash. The main distinction is that a HELOC is a revolving credit line, like a charge card, that comes with a variable rates of interest.

Numerous times, you have the advantage of low, interest-only payments during this phase. Once the settlement period begins, you can not withdraw from the credit limit any longer and need to repay the loan equilibrium and rate of interest completely. A HELOC is a great selection for debtors that recognize they want to make several purchases or cover recurring expenditures, or those that might take advantage of interest-only settlements during the draw duration.

The Only Guide for Home Equity Loan copyright

Unlike the other alternatives we have he has a good point actually mentioned, it doesn't link your brand-new financial debt to your home. This can supply some tranquility of mind but, due to the fact that there's no security safeguarding a personal finance, they normally come with greater interest rates.

Since you are utilizing an asset to guarantee the financial debt, the amount you can borrow can be fairly big, and the rate of interest prices are exceptionally low much less than bank card or individual lines of debt. There are numerous various sorts of home equity lendings, yet a lot of them come under among the complying with two classifications: Lump-sum settlement: With this design of loan, you receive a big lump sum repayment simultaneously and pay back the amount over time at a set rates of interest.

How Home Equity Loan copyright can Save You Time, Stress, and Money.

For instance, if your home deserves $350,000, and you owe $200,000 on the home mortgage, the optimum you could borrow versus your home is $80,000. To receive a home equity finance, you'll need at the very least 20% equity or even more in your house. You'll likewise need a debt-to-income ratio no greater than 43%.

When you get your funding, it can go to this website take a number of weeks to be authorized and you'll need to submit to a comprehensive explore your credit report and work. You might have to pay costs like appraisal fees, title search, title insurance policy, and lawful charges. If you are older than 55 and you're retired, you might not wish to or be able to secure a home equity funding.

There are 2 big drawbacks to a home equity finance (Home Equity Loan copyright). A reverse home mortgage is a kind of home equity finance., you still utilize your home equity as collateral to obtain money, and you are still billed rate of interest on your car loan.

Come to be a property owner: Transform your home into an income source by renting a room or a cellar home. Downside: You can market your home and purchase a smaller place, transfer to a cheaper location or invest the equity and rental fee. If you're thinking about a traditional home equity finance or a reverse home mortgage, it is essential to consider your requirements when choosing in between the 2.

The Facts About Home Equity Loan copyright Revealed

motusbank offers home equity loans for as reduced as 3.75%, whereas you'll pay 5.5% or more for a reverse home mortgage. That tiny difference in rate of interest may not seem like a lot, but if you are obtaining tens of countless dollars over an extended period, even a tiny rate of interest price distinction will result in substantial cost savings over the car loan term.

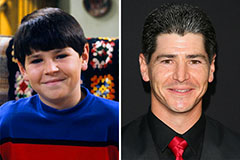

Michael Fishman Then & Now!

Michael Fishman Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!